Many women in tier 2 and tier 3 cities have developed some degree of bias against digital payments because their family members and relatives had a bad first experience (when the family members made the transactions for the first time). Because of this, the women developed the perception that digital transactions are unsafe.

The role of women is sacrosanct for the growth and development of the MSME segment in India. The participation of women in Indian MSMEs has been considerably high in comparison to other sectors.

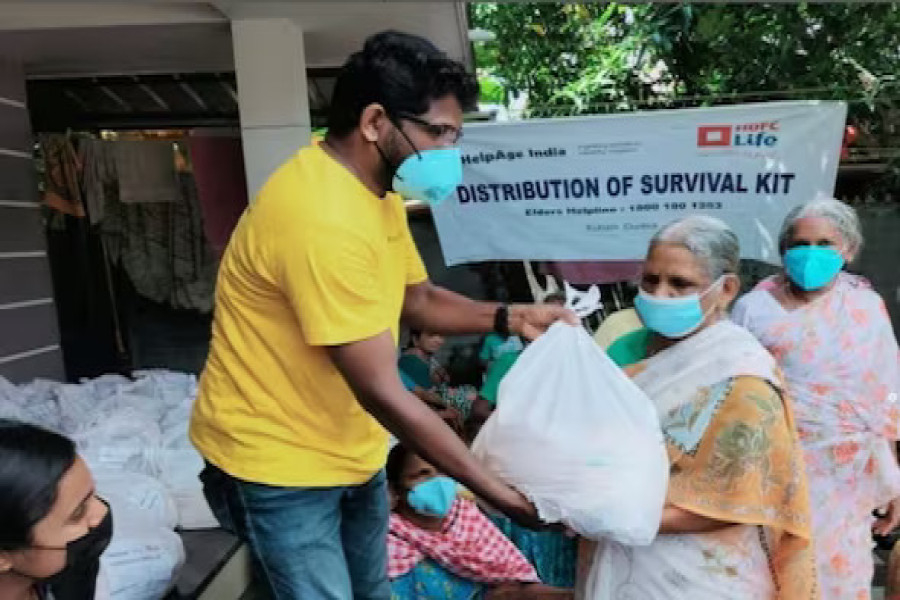

After the inception of the COVID-19 pandemic, the MSME segment in India suffered a crash in the supply chain. Several small-scale industries were not able to procure basic inputs and raw materials, majority of the MSMEs suffered from a capital crunch as most of the women entrepreneurs didn’t have a proper credit score to avail loan from a bank and other formal institution.

The pandemic has revealed many ruptures in the current system and it is imperative that we should learn the lessons that the pandemic has taught us so that we don’t repeat the same mistakes again. It is imperative to address the digital and financial divide in India as merely 32% of women own a mobile phone in India compared to 60% of men.

Digital payments are growing at an unprecedented pace. According to the National Payments Corporation of India (NPCI), UPI recorded over 7.82 billion transactions worth Rs 12.82 trillion in December 2022—a new record since it was launched in 2016. 44.63 crore Pradhan Mantri Jhan Dhan Yojana (PMJDY) accounts were opened, with deposits amounting to Rs.158,713.30 crore, in seven years till 26th January 2022.

But even after these steps taken by the government, there is low usage of UPI among women (especially those women belonging to Tier 2 and Tier 3 cities). There is also a problem of account dormancy and zero-balance accounts among women, where the majority of accounts opened during the PMJDY are only being used to receive Direct Benefit Transfers from the government.

According to the white paper published by MicroSave Consulting and NPCI, there are three barriers that continue to inhibit the adoption and usage of digital payments in India:

1) Customer Level barriers: behavioural and structural barriers faced by customers that inhibit their adoption of digital payments 2) Provider level Barriers: Lack of customer-centric solutions for low- and middle-income (LMI) people in the country to adopt digital payments 3) Ecosystem level barriers: lack of frontend and backend systems to enable digital payments.

The women in tier 2 and tier 3 as well as the MSMEs majorly fall prey to the first two barriers (i.e., the Customer level barriers and Provider level barriers). The literacy rate among women and some pockets of urban areas is as low as 67.77% as compared to 84.11% in urban areas due to which there is a high level of apprehension and fearfulness among women in rural areas to make digital payments.

The reason for their apprehension is that they fear that they may send the money to the wrong person after which they will never be able to retrieve the money back. The majority of the women in tier 2 and tier 3 cities had also developed some degree of bias against digital payments because some of their family members and relatives had a bad first experience (when the family members made the transactions for the first time) because of which the women developed a perception that digital transactions are unsafe.

As mentioned at the beginning of the article, women’s participation in the MSMEs has been high in comparison to other sectors in India, however, most of the women employed in the MSMEs in the tier 2 and tier 3 cities, receive their monthly salary in cash which is another hindrance for lack of adoption of digital payments among women.

Building the overall financial and digital resilience of women provides a paramount substructure for the overall growth and development of the MSMEs which will bolster the overall boost of the village's economic growth. A high degree of digital resilience of women will further boost the technological innovations in the field of finance to achieve Integrity, Inclusion, Innovation, Institutionalisation, and Internationalisation strengthen the digital payment ecosystem in India according to the Payment vision document of the RBI

In order to achieve the payments vision of the RBI and increase the financial readiness of women we have to increase the Awareness, Accessibility, and Usage of digital payment services among the women.

To build awareness we have to rope in local bodies like panchayat workers, self-help groups, and other institutions like State Rural Livelihood Missions (SRLMs) so as to increase the awareness and importance of digital payments among women. The local NGOs and government can also collaborate with the micro-influencers in the local villages to increase the awareness of digital payments among women.

To increase the accessibility of UPI applications among women, the provider of the digital payment services should ensure a seamless and smooth onboarding experience for the women, the first few experiences of using the digital payments should provide a delightful experience to the women (who would be using UPI for the first time).

A significant number of fintech players are heavily dependent on the bank infrastructure because of this the banks are not able to process and handle the excess payment request demands from the customers. Heavy reliance on bank infrastructure is the primary reason why there are transaction failures while conducting a digital transaction.

There are increasing challenges for the fintech companies related to cyber security and data privacy as all the major fintech companies collect and store sensitive financial data because of this these companies are more vulnerable to any potential cyber-attack.

To enhance the usage of digital payment applications, the product developers of the applications should synthesize and harness customer-centricity tools to increase the usage of the UPI apps. Developing subtle nudges in the app and adopting a model like that of “BC Sakhis” by the fintech players in the local communities can provide assistance to women and increase the usage of digital financial services among women.

Financial inclusion is still an unaccomplished target, especially among women belonging to the lower and middle-income groups. There are not merely demand-side challenges but supply-side issues as well that abstain from the overall digital and financial ecosystem of the county and in the Amrit Kaal we should make sure that all the women in our country are financially included so that they can play an equitable role in the overall growth and development of India.

(Dr. Heera Lal is an IAS officer, Shivansh Gupta is an Associate at MicroSave Consulting, New Delhi; Views are personal)

Reference Link : https://government.economictimes.indiatimes.com/blog/atmanirbhar-naari-for-an-atmanirbhar-india/103574301

.jpg)